Facebook ads is a beast of it’s own and it plays by it’s own set of rules. It always has and it probably always will.

Facebook has been tangled up in a series of lawsuit involving discrimination by ads that ran on it’s ad platform. One of which was in March 2019 where it was alleged that Facebook allowed housing advertisers to restrict who was able to see ads on the platform which in turn discriminated against certain socioeconomic classes for certain types of housing. The trickle down effect was far reaching and resulted in Facebook becoming far more conservative about what type of targeting advertisers could use in their campaigns.

Recently Facebook created something called the “Special Ads Category.” This special category applies to ads that are in certain categories and restricts the type of targeting that can be used for that advertiser.

Here is Facebook’s official definition of the “Special Ads Category:” If you’re based in or targeting the U.S. and are creating a campaign that includes ads that offer credit, employment or housing opportunities, you must choose the category that best describes your ads. These are special categories for which audience selection tools are limited to help protect people on Facebook from “unlawful discrimination.” Choosing the correct category for your campaign is an important part of following Facebook’s advertising policies (or you can get banned). These special categories include, but are not limited to ads that offer credit, housing or employment opportunities.

Here are the definitions of each category according to Facebook:

Special Ad Categories

Credit Opportunity: Ads that promote or directly link to a credit opportunity, including but not limited to credit card offers, auto loans, personal or business loan services, mortgage loans and long-term financing. This also includes brand ads for credit cards, regardless of a specific offer.

Employment Opportunity: Ads that promote or directly link to an employment opportunity, including but not limited to part- or full-time jobs, internships or professional certification programs. Related ads that fall within this category include promotions for job boards or fairs, aggregation services or ads detailing perks a company may provide, regardless of a specific job offer.

Housing Opportunity or Related Service: Ads that promote or directly link to a housing opportunity or related service, including but not limited to listings for the sale or rental of a home or apartment, homeowners insurance, mortgage insurance, mortgage loans, housing repairs and home equity or appraisal services. This does not include ads designed to educate consumers or housing providers about their rights and responsibilities under fair housing laws. You can include the Equal Opportunity Housing logo and slogan to help differentiate your ads as non-discriminatory.If you’re ad falls into one of these categories the audience selection tools that you get access to are limited. Certain targeting options are not available for ads in special categories; this includes Lookalike Audiences, age, gender or ZIP code. You can at a minimum target 15 miles or more around an address. You can also only target certain interests. I think Facebook’s goal here is to be more “mass market” advertising and less laser focused in these categories, this way they can’t get sued.

—

One category that I operate in is the automotive niche for car dealerships. When I initially heard about this new Facebook initiative I didn’t think that we’d be effected much since we don’t typically advertise credit opportunities. Most of our clients advertise car pricing or brand messaging so I thought we’d be in the clear. Boy was I wrong. As soon as the new rule went live most of our ads were disapproved because they qualified for the special ad category. The reason that many of our clients as well as other automotive clients use Facebook as an advertising tool is because of their ability to offer very granular targeting. Many dealerships want to target specific zip codes because their businesses are extremely local. I’ll give you an example. Let’s say that a car dealership is located in Weehawken, New Jersey. That dealership is not going to be ok with a 15 miles radius around their dealership for advertising.

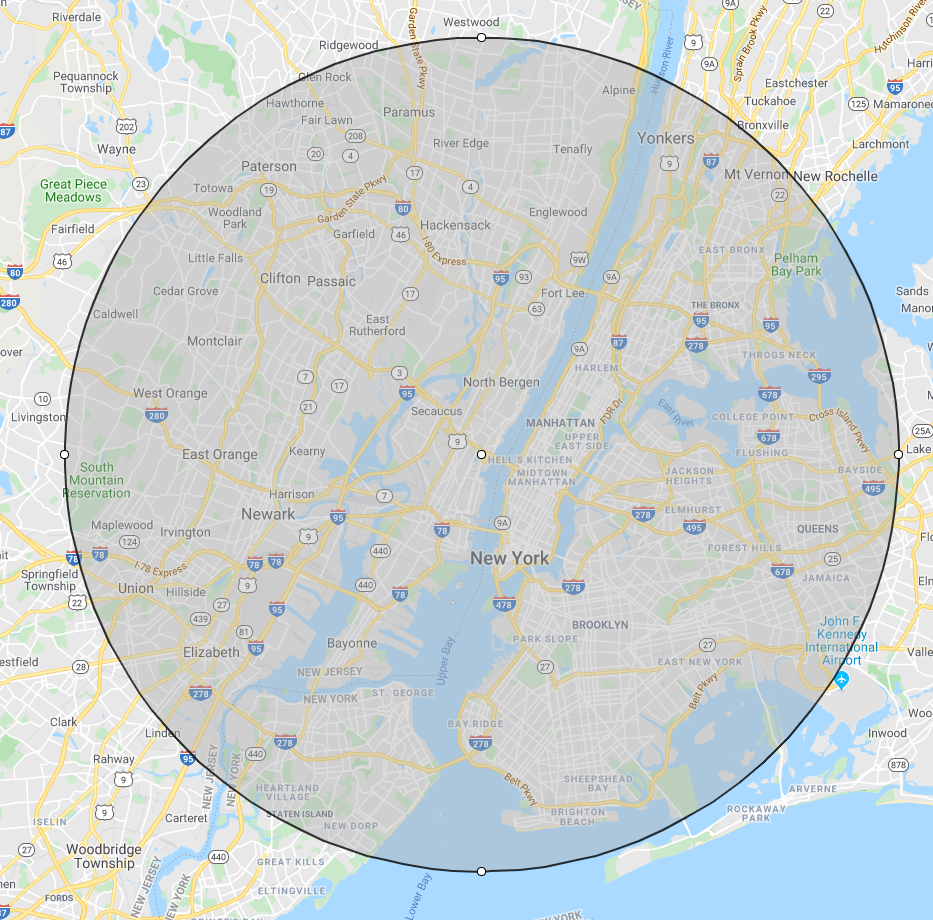

Here is a picture of what 15 miles around Weehawken, NJ looks like

A car dealership in Weehawken, NJ wants to market to people predominantly in New Jersey only. There are multiple reasons for this. People from NYC probably won’t make the trip if they are looking for a car because it’s not convenient. Furthermore many Manhattan residents don’t have cars so advertising to this population could prove to be a waste of money. For a dealership like this it’s going to be vital to stay out of the Special Ads Category to avoid this radius targeting issue.

I figured there would be a way around this if I just read Facebook’s rules and tried to work within them. This lead me to an extensive series of testing to see what would work and what wouldn’t. I want to share those tests with you to help you avoid the same problems and to talk about something that I haven’t seen much about online to date.

Test #1: I figured that a standard carousel ad with lease offers wouldn’t be a problem since it wasn’t an offer of credit. I was wrong. This was disapproved. After fighting with Facebook Support for a while I got it approved, only to have it get disapproved again the next day. The explanation I was given by support was that since there was a link on the dealerships website for financing, this falls into the credit opportunity special ads category and was unacceptable for regular advertising.

Test #2: I set out to beat Facebook at their own game so I created a landing page with the dealership’s specials on it. I used my own domain name so that it wasn’t associated with the dealership’s website at all. I limited the outgoing links and controlled the entire environment so there were no links to a finance page. Based on my last conversation as to why my ads got disapproved I figured this was a pretty creative solution that would work. Wrong! Disapproved. After some arguing because I had a point to prove to Facebook I got it approved. Then guess what, the next day it was disapproved again. The reasoning this time was something along the lines of that since they are lease prices the offer is a long term financing offer and hence has to be advertised in the credit opportunity special ads category.

Test #3: At this point I was just frustrated because even Facebook didn’t have a clear explanation about how their rules worked. I was going to really stick it to them this time with an indisputably safe ad. I went and did a whole Facebook Lead ads setup. I created a Facebook form on the clients Facebook page. I then took 3 cars from the dealership’s inventory with buy-for pricing. When the person clicked the ad it wouldn’t even go to the clients website, it would go to a lead form. Based on all of the prior feedback I thought this was a sure thing. The prices were buy-fors (not long term financing) and the form is completely within Facebook’s control with no financing links. Disapproved. No real explanation given.

Test #4: Now I’m starting to think that with all of my arguing and disapproved ads/campaigns that i’m on the radar and that no matter what I do i’m going to get disapproved. I then devise a theory that I’m not on the radar if I start a completely new second ads account which was a pain but worth a try. I then repeated Tests 1-3 and everything was once again disapproved. No forward progress, so this theory was just false.

Test #5: The next test was an ad with no pricing simply promoting the dealership and going to a facebook lead form. I figured this should be an easy approval since there aren’t even any prices and we aren’t leaving Facebook. Fail. Disapproved ads again. Now fighting with support is just getting me nowhere and they are saying that because it’s a car ad it belongs in the credit opportunities special ad category which makes zero sense based on the definition of the special ads category

Test #6: I came up with a new theory. Maybe because each ad that i’m creating is coming from the Facebook page of a car dealership and it’s labeled as such since every Facebook Page has a category (In this case they are Automotive Dealerships) that there is some kind of rule that if an ad is created from a page in a certain category and isnt labeled to be in a special ad category then automatically disapprove it. I thought this was a pretty smart theory and my test to prove or disprove it was that I created a completely new Facebook page for one of our car dealerships called “Dealership Name Espanol.” I put the page in the wrong category intentionally. Then I retried test #5. Disapproved. Frustrated. Defeated.

Test #7: My idea was to create an ad where we are buying back vehicles. We aren’t selling them, we are buying them back. In theory how can you disapprove me for offering money for a vehicle. There is nothing even remotely credit oriented. Disapproved.The bottom line is that if it’s an ad that Facebook believes should be in the “special ad category” and you don’t select “special ad category” you are getting disapproved. All of this is not to say that you can’t run Facebook Ads for clients in these categories. You CAN, but you need to deal with the restrictions of the “Special Ad Category.”

So what are your options?

1 – Run with very limited targeting. This is not an ideal option

2 – Use something that Facebook has created called the “Special Ad Audience.” This is essentially the same thing as a lookalike audience but they don’t use the attributes of age, sex or zip code as part of the algorithm that they create lookalikes from. The “Special Ad Audience” can be based off of a website pixel audience or an uploaded list just like any other lookalike. This is a decent option but will require testing to see how these audiences convert versus traditional lookalikes. In my initial testing it performed about the same.

3 – Find third party data that has the kind of targeting you want and upload it to Facebook with a customer match. You won’t get a 100% match rate but you’ll be able to target the people you want without limitations. There are several data companies and list providers that provide this type of data.

I hope this helps you. If it does, be sure to share with a friend or colleague. If you have something to add please converse with me in the comments or on social media.

~Ad Hustler

Be First to Comment